LAND MANAGEMENT

Better planning & resource allocation

Our solutions help high-value land managers to plan and improve their day-to-day and weekly operations. From irrigation/water scheduling, pesticide and fertilizer reduction, energy, water and emission savings, labor planning, to improved identification of weather windows for controlled burns. We have you covered.

We enable better land management decisions by delivering real-time in-field observations that help you to improve your operations and resource planning.

ACTIONABLE DATA

Location-specific alerts

Our solutions reduce the uncertainties resulting from the discrepancies between the environmental conditions at the nearest weather station and at the asset’s location (e.g., farms, preserves, resorts). These discrepancies cause unsuitable management decisions to be made. Our alerting system offers location-specific environmental alerts to high-value land managers to improve their operations.

LOCALIZED FORECASTING

What is unique about our innovation?

Unlike traditional weather forecasting approaches, we offer environmental forecasts for specific locations (latitude, longitude, elevation) rather than mean forecasts over an area (grid).

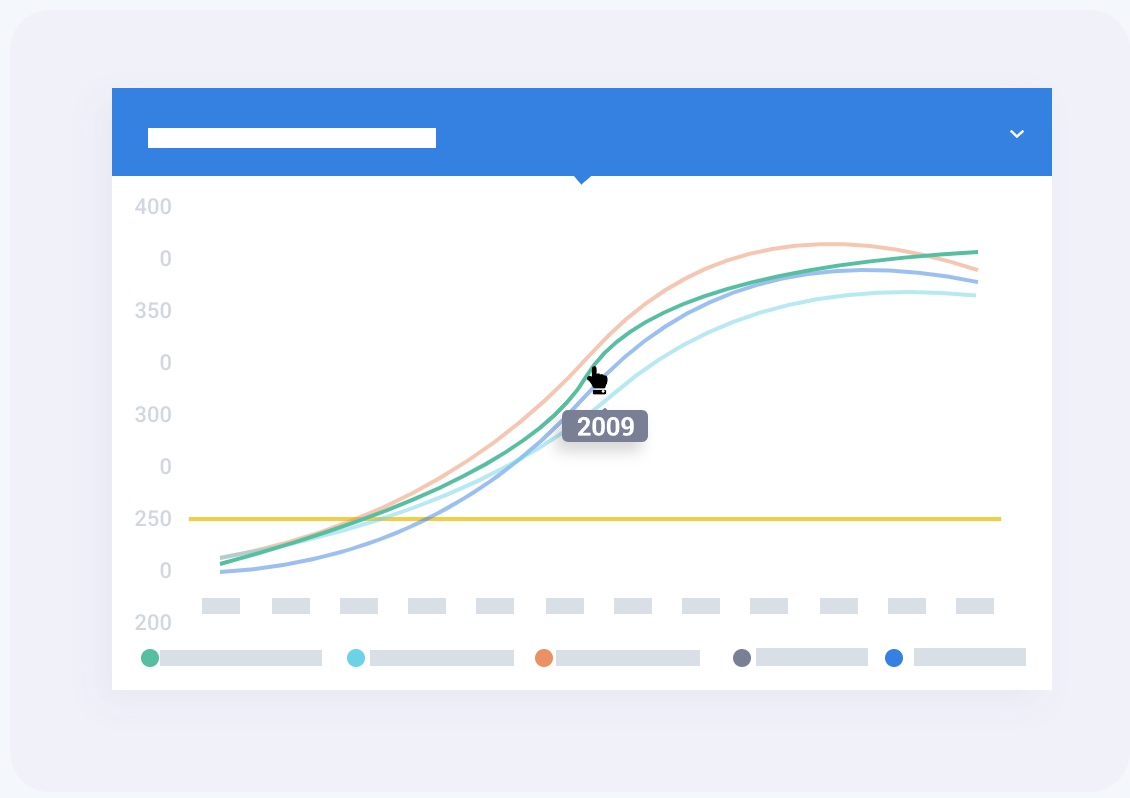

HISTORICAL DATA

Understand weather history

No matter the location of your asset, our API provides access to location-specific historical weather data to enable contextualization of the current conditions versus historical values.

By comparing current and historical conditions at the asset level, our users can contextualize today’s weather more effectively, thus allowing better management & operational decisions.

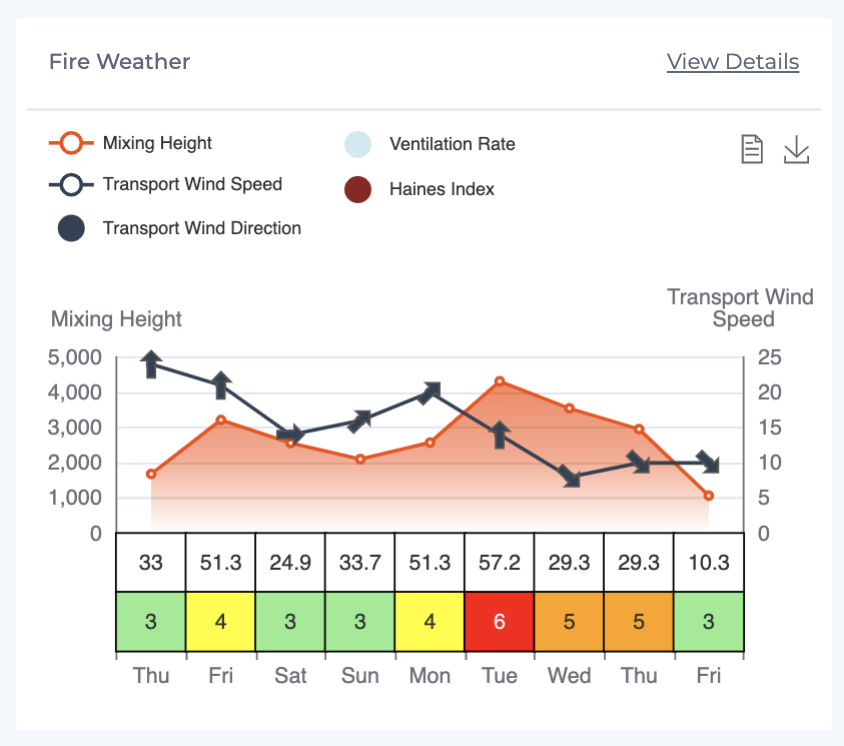

BURNCAST

Helping land managers with controlled burns

We developed Burncast -our specialized fire weather visualization tool- in close collaboration with preserve managers and organizations involved in performing and planning controlled burns to prevent catastrophic forest fires.

Our location-specific forecasts, recommendations and alerts helped them to reduce the number of false positives, manage labor and improve their land management schedules.

Get started today!

Start improving your business.

With the support of